Impact Factor : 0.548

- NLM ID: 101723284

- OCoLC: 999826537

- LCCN: 2017202541

Abban Stanley*

Received: June 24, 2024; Published: July 11, 2024

*Corresponding author: Abban Stanley, Kwame Nkrumah University of Science and Technology, Ghana

DOI: 10.26717/BJSTR.2024.57.009011

The Economic Community of West African States (ECOWAS) was established as a Regional Economic Community (REC) per articles 3 and 51 to 55 on 28 May 1975 under the treaty of Lagos, as a free trade area (FTA) to achieve intra-regional commerce and economic integration. It was signed by 16 member countries namely: Nigeria, Cote D’Ivoire, Ghana, Burkina Faso, Togo, Benin, Mali, Niger, Guinea Bissau, Senegal, Guinea, Liberia, Sierra Leone, Gambia, and Cabo Verde with Mauritania opting out in 2000. Article 27 of the Treaty, asserts a long-run aim of establishing community citizenship for all members to remove obstacles of free movement of people, capital, and goods. The ECOWAS in bridging the gap between its member states and creating a trade enabling environment developed a trade framework such as the ECOWAS Trade Liberation Scheme (ETLS) implemented in 1979. In the year 1987, the ECOWAS Monetary Cooperation Program (EMCP) was to work out to reduce currency convertibility among member states and bring about a single currency.

The Abuja treaty was the blueprint for integration in Africa signed on 3rd June 1991 as an integral part of the African Union (AU). The main purpose of the treaty was to enhance regional and continental economic integration and to boom trade in industrial products and cause structural change in the industrial sector to establish an African Economic Community (AEC) which proceeds to a monetary and economic union by 2028 as stated in Article 2. Despite the rattling effort of ECOWAS, the level of trade remained robust, below 12% of total trade (UNCTAD database, 2018). Currency union was viewed as a panacea of struggling economies, so ECOWAS deems it fit to strengthen ties of member countries further to improve the standard of living through trade stimulation. ECOWAS sub-region was characterized by two zones namely; the West Africa Economic and Monetary Union (WAEMU) and the West Africa Monetary Zone (WAMZ). The initial plan of a single currency in the sub-region was, to begin with, the WAMZ in the year 2003 and later emerge with the WAEMU, which had the CFA XOF as a common currency in 2020. Countries in the WAEMU namely Cote d’Ivoire, Burkina Faso, Togo, Mali, Benin, Guinea Bissau, Senegal, and Niger, which forms part of the CFA zone, trade more compared to countries using their sovereign currencies in the WAMZ due to sound macroeconomic indicators coordinated by BCEAO, their central bank. The projected members of the WAMZ consist of six countries, namely Nigeria, Ghana, Guinea, Sierra Leone, The Gambia, and Liberia. Article 8 of the Supplementary Act (2012) in line with Article 1 of the ECOWAS treaty, outlines the convergence criteria set for member states to achieve the target by 2020 to ensure the law of one price to stimulate cross-country trade in the sub-region. The ten convergence criteria were laid out ex-ante as a yardstick for joining the union. The four-consecutive postponement of the ECO currency initiation was attributed to the inability to attain the primary target of fiscal deficit less than 4%, and other achieved targets unsustainable in the periods under review [1].

ECOWAS revised the convergence criteria to six to fast-track the formation of the proposed currency union for the two zones in 2018. According to [2], sovereign monies also serve as a significant barrier to international trade. Countries in a currency union would trade more due to; elimination of exchange rate uncertainty, reduction in trading cost, and easier comparison of prices across borders [3-5] The main disadvantage of adopting a common currency is the presence of asymmetric shocks among member states. However, a currency union in West Africa can partly be stabilized against asymmetric shocks by providing credit facilities coupled with strict fiscal discipline by national fiscal authorities in line with deliberating democratic process, foreign aid, and trade openness [6].

As trade increases, business cycles can in principle move either more asynchronously or more closely together to nullify shocks and converge [7,8]. Moreover, the European Monetary Union was well documented as debt fueling. Contrarily, the plight was attributed to public sectors been very large with a greater share of public expenditure funded by external debts, the lack of a binding policy on debt restrain, and the ability to borrow cheaply from the international culminated in the chunk of debts. The striking advantage of developing countries in forming a currency union has to do with relatively lesser nominal rigidities, relatively small public sectors, greater trade potential, and the elimination of greater costs associated with the use of sovereign currencies. The success and foresight of ECOWAS towards unleashing trade potential and ensuring security have led to countries such as Mauritania and the Kingdom of Morocco opting to join the sub-region in 2018. The ECOWAS sub-region is plagued with trade and non-trade barriers leading to the low level of trade in the sub-region (AfDB, 2018). In this background, intra-regional trade in West Africa is consistently below 12% of total trade (UNCTAD database; ECOWAS, 2015).

The non-trade barriers consist of smuggling, bribery, and corruption, embezzlement of national coffers, security-related issues, wrong invoicing among others. (AfDB, 2018). These non-trade barriers increase the cost of trading and culminate in the large informal sector. Other significant barriers to trade in West Africa are tariffs, import restrictions, and export restrictions utilizing bans and quotas [9]. Currency union has proven to be a panacea for these ills Empirically, the most performing RECs in Africa compared to ECOWAS, have currency arrangements that favour trade. Trade-in East Africa Community (EAC) is facilitated by the convertibility of the Kenyan shilling. Moreover, Trade is enhanced in the Southern Africa Development Community (SADC) due to some currencies pegged to the South African Rand in the South African Customs Union (SACU). Statistically, EAC and SADC trade averages at 19.1% and 15.1% respectively compared to 9.0% recorded by ECOWAS using averaged intra-trade data from 2000 to 2017 (UNCTAD, 2018). Furthermore, the WAEMU, part of the ECOWAS, averages at 13.7% due to the use of a common currency (UNCTAD, 2018). Therefore, the use of sovereign currencies by countries in the WAMZ, which forms part of the ECOWAS, could be a barrier to trade.

Also, the high dependence on the primary sector by ECOWAS countries has necessitated the need for diversification of the economies. In this background, the danger of climatic change and population growth will diminish economic gains from the sector. According to the Intergovernmental Panel on Climate Change (IPCC), GDP across Africa is expected to reduce by 2% - 4% by 2040 due to climatic change. This would represent a loss of about $ 653 million to about $1 billion in 2040 using exchange rates in 2018. In this background, it necessitates the exigency of the ECOWAS countries to diversify their economies and initiate regional population control policies. Currency union with a common policy has proven to improve the economic stance of struggling economies through healthy competition and the practice of comparative advantage.

Exchange rate volatility is presumed to have a small effect on trade flows due to country-specific analysis using a dataset measured in dollar equivalence, which reduces the marginal disparity of sovereign currencies. Also, the non-convertibility of currencies shadowed the effect of sovereign currencies on trade. Additionally, the use of foreign currency to undertake intra-regional trade has caused an economic discrepancy in the estimation of exchange rate volatility on trade. However, the exchange rate volatility harms trade and is further worsened by the high demand for foreign currency to undertake intra- regional trade. The theory postulates small open countries benefit from forming a currency union so reinstating the exigency for West Africa to undertake the initiative. Therefore, the currency union could serve as a panacea for the ills in the West Africa sub-region should the policy be realized. Empirically, when countries integrate, the volume of trade appreciates significantly to stimulate economic growth. In this context, such policy stimulating trade flows have proven to reduce asymmetric and external shocks, ensure convergence through business cycle synchronization, create employment opportunities hitherto economic growth.

Most empirical studies on West Africa focused on the feasibility of currency union using notably the Optimal Currency Area (OCA) criteria and other econometric techniques. These studies focused on the compatibility of countries in terms of shocks, similarities in macroeconomic indicators, and business cycle synchronization in forming an optimal currency area. In this background, [10-13] amongst others tested the macroeconomic convergence of the ECOWAS countries in forming a currency union. The results showed countries are not prepared to adopt a common currency due to the inability to fulfill the OCA criteria therefore such policy will surface at a greater cost. However, exchange rate intensifies shocks, enhances differences in macroeconomic indicators, and widens the trade gap by increasing trade costs. Moreover, empirical studies using the OCA criteria showed the European Monetary Union was not an Optimal Currency Area, before the currency union [14,15]. Despite the EMU, not an OCA, the currency union stimulated trade flows among member states (UNCTAD database, 2018). A recent evaluation of the EMU countries based on OCA criteria showed countries were converging with the introduction of the Euro [16,17].

Given this, evaluating the feasibility of a currency union in West Africa by using the OCA criteria will fail in predicting the trade effect of the policy. These existing studies using OCA criteria in evaluating currency union feasibility failed to acknowledge the effect of a common currency on trade and the significant effect of trade in nullifying shocks among member States. Furthermore, there are limited studies on the evaluation of the feasibility of ECOWAS currency union on intra- regional trade, unlike the OCA. In this context, the only existing study estimating the prospect of ECOWAS currency union on intra-regional trade was Anokye and Imran (2013). The results showed a currency union would improve the level of trade in the sub-region using a linear model. Contrarily, Monte Carlo simulation tests have shown the gravity model of international trade is best estimated as a non-linear model [18-20].

Given this, the study seeks to evaluate the prospect of ECOWAS currency union on trade using the Poisson Pseudo Maximum Likelihood (PPML) estimator which is a non-linear estimator. Additionally, the study failed to empirically show the impact of sovereign currencies on trade in the sub-region. Essentially, currency union membership can lead to trade, yet hurt welfare notably when trade with efficient non-members is reduced. In this context, the study seeks to evaluate the trade creation or diversion effect. In this context, it will unveil whether the policy of a common currency will have a positive impact on economic growth or not. In conclusion, the study seeks to investigate the trade potential of the ECOWAS sub-region to reinstate the possible significance of enhanced trade among members.

The rest of the paper is organized as follows: the next section provides the theoretical framework, model, and empirical strategy. Section 3 presents the data and measurement. Section 4 presents the results and discussion. The last section concludes the paper with some policy suggestions.

Theoretical Framework, Empirical Literature, and Model to be Estimated

The study reviewed four theories namely; the OCA theory the gravity model of international trade, trade creation/trade diversion theory, and theory on exchange rate volatility and Export. The theoretical premise for studying currency union effects on trade can be gleaned from the Optimal Currency Area (OCA). The Optimal Currency Area (OCA) theory can be attributed to [21,22]. The theory postulates that countries with high labour mobility, a high degree of openness, substantial product diversification, sufficient flexible price and wage, effective monetary policy, similar inflation rates, and the zeal to abandon their currencies will benefit from forming a currency union. Mundell postulated that a common currency reduces transaction costs leading to trade creation. High factor mobility especially labour mobility among the countries was key in forming an OCA in a fixed exchange rate regime. [22] argued that the degree of openness as a relationship between tradable and non-tradable is crucial in forming an OCA. The more economies are opened to one another, the higher the tendency of forming an optimal area. For a currency area to be optimal, [21] argued that asymmetric shocks can be nullified with free labour mobility by liberalizing factor markets in the area. [22] argues an OCA is a region with a common currency and within which monetary policies, fiscal policies, and flexible exchange rates can address issues related to price stability, employment, and international payment which are conflicting. He suggested the need for the economies to be well integrated to reduce the exchange rate effect. He investigated the consequence of the size of currency unions and argued that small nations are more liable to trade and have lesser nominal rigidities.

Therefore, suitable for the formation of a currency union. [23] introduced product diversification as an important criterion for an OCA. He argued that diversity in products of the countries and the number of single product regions in a currency union is most relevant to form OCA as compared to labour mobility. Product diversity is a key factor for labour to move within a region. He further argues that when a region has a well-diversified export sector and homogenous labour with high mobility, there is a tendency for the region to form an OCA. [21] concentrated on the cost involved in joining a currency union whereas [22,23] focused on the conditions for enhancing the benefit for an optimal currency area. The OCA focuses on the balance between the benefit of reduced trade cost and the cost of abandoning monetary sovereignty and business cycle synchronization of the member states. The theory concludes that there is a need to experience symmetric reactions to external shocks to lower the cost of regionally coordinated policies. [24] argued that using a common currency may help an area to be optimal. This will reduce unsynchronized economic shocks leading to the creation of an optimal area. Mundell further posits that purchasing power parities should exhibit steadiness overtime. Thus, with the free movement of capital, there is the tendency of attaining an OCA.

Countries in fulfillment of the OCA criteria benefit from reduced transaction costs, price transparency, deepened and integrated money, and capital markets, elimination of extreme nationalism, healthy competition to enhance trade through the facilitation of export diversification, and induce FDI as a result of sound macroeconomic indicators. The cost of forming a currency union per the OCA is; the inability of countries to respond to idiosyncratic shocks worsens the economic situation of the area. The ability to overcome external shocks was a factor to evaluate when introducing a new currency. To add up, the loss of monetary sovereignty by member countries and the mechanism of the exchange rate which is dependent on the effectiveness of monetary policies. The OCA does not account for the political influence in the formation of the currency union. Thus, there are other benefits to currency unions than just trade.

The Gravity Model of International Trade

In 1962, Tinbergen propounded the gravity model of international trade emanated from the Newton law of gravity. The gravity model of trade intuitively posits that trade between the two countries depends on their economic strength (GDP or GNP) and is inversely related to the trade cost. It states that for two countries to trade, it depends on their level of income and the distance between them. The greater the economic mass of the countries coupled with relatively small distances, more countries will tend to trade more and vice versa. It is calculated as the log product of their economic strength divided by the log distance (log values of the trade costs). The model has stood the test of time in predicting the volume of trade among nations. The model has been consistent in its prowess in using real data to determine the sensitivity of trade flows concerning a policy component. Pöyhönen (1963) was the first to use in estimating trade flows between countries using cross-sectional data. The variables used in his estimation were export, population, Gross National Product (GNP), GNP per capita, and distance.

Linneman (1966) proposed an alternative model to international trade by adding a preferential treatment dummy and gave an intuitive explanation about the Walrasian model. McCallum (1995) modified to estimate trade of 22 times more of provinces in Canada than trade with the United States. Anderson (1979) was the first to develop a gravity model with product differentiation incorporating a Cobb Douglas and constant elasticity of substitution (CES) preferences. The theoretical determination of bilateral trade using the gravity model was first modelled by Bergstrand using constant elasticity of substitution (1985, 1989). The model was adjusted in the framework of product differentiation with increasing returns to scale (Helpman and Krugman (1985). Brada and Méndez (1985) used the gravity model to estimate trade due to economic integration. Rose (2000) used historical data in the gravity model of international trade to estimate the effect of adopting a common currency on trade using data before currency union establishment in the European Monetary Union (EMU). The model was used in the prediction of the currency union effect on trade.

Theoretically, the model is used to distinguish the effect of exchange rate volatility and currency unions to estimate the trade effect on an economy. Anderson and Wincoop (2001) worked on the adverse effect of trade barriers on trade. The rejuvenation of the gravity model of international trade in estimating the volume of trade has led to some empirical works undertaken in West Africa. The model has further been enhanced to accommodate several economic theories such as the Richardian and Heckscher-Ohlin trade theories. This study seeks to establish a nexus between cross-country variation in currency arrangements and international trade.

Theory on Trade Creation/ Trade Diversion

The theory of trade creation-trade diversion was propounded by [25]. The theory states that when countries integrate economically, there is a tendency that the flow of goods would be increased or there would be a change in the pattern of the existing distribution chain of goods. According to Viner (1950), trade creation leads to unleashing untapped trade potentials among the trading member states and therefore improve welfare. Trade diversion distorts the trading pattern by diverting trade from the cheapest supplier state to another within the union, and this becomes cheaper only due to the removal of tariffs but expensive for non-members. In the simplest form, trade creation can be defined as the replacement of high-cost domestic production with low-cost subsidiaries from trading countries while trade diversion is a shift of imports from efficient producers from non-members to relatively less efficient producers in the partnership agreement. The theory is underpinned by the significance of price changes to the trade pattern of member states. He pointed out that regional trade agreements do not ostensibly lead to gains even though some tariffs are eliminated. Therefore, trade agreements ensuring trade creation are the best. In this background, it laid down the fundamentals for welfare-enhancing trade arguments.

Theory on Exchange Rate Volatility and Export

Exchange rate volatility shows the level of risk involved with changes in the exchange rate. Exchange rate volatility is associated with either rise or a fall in the level of exports depending on the assumptions about the variable. Conventionally, exchange rate volatility is argued to hurt exports since it increases the risk or shock involved in international trade. The prospective gains from international trade by firms are uncertain due to exchange rate volatility due to currency risk (Broll, 1994, 1995). Moreover, even with well-developed forward markets for some currencies, exchange rate volatility cannot be eliminated since it affects exporting firms in diverse channels of trade. An increase in exchange rate volatility increases the risk involved in trading, therefore, reduces the volume of trade with risk-averse firms. These risks are often transferred to the importing countries since contracts are initiated in exporter currency hitherto affecting the price level [26]. There is difficulty in the prediction of the domestic value of foreign transactions due to exchange rate volatility. This results in the uncertainty of investment and trade therefore hedging exchange rate risk becomes expensive even in a well-developed forward market [27].

Uncertainty reduces the level of production hitherto the level of exports amongst trading partners by affecting the decision process of investing in a country. The higher the volatility, the greater the fall in the trade volume. In this context, it also affects income volatility (Baum et al, 2001). In the same vein, exchange rate volatility adversely affects trading countries practicing the floating exchange rate. Contrarily, another theory on exchange rate volatility on exports shows even in the face of risk associated with volatility, it presents an opportunity for firms to maximize profits. In this background, exchange rate volatility can have a positive impact on the volume of trade.The option theory stipulates in alignment that firms with the option to export are better off when the exchange rate is volatile (DeGrauwe et al, 1993). On average, exchange rate volatility can stimulate trade since it shows a greater probability that ex-post deviations from the commodity price parity will be larger than tariffs and transportation costs [28]. Volatility is the unobservable or latent variable, deterministic, or stochastic [29]. However, these studies have made exchange rate volatility an observable variable with mixed results.Empirically, Qureshi and [30] use cluster analysis to the suitability of common currency for West African countries with multivariate data. The clustering was performed over three overlapping periods (1990 to 2004, 1995 to 2004, and 2000 to 2004), with multivariate data.

The results showed there was a significant lack of homogeneity within the WAMZ with Ghana and Nigeria appearing as independent singletons. The study casts doubt on the possibility of establishing a monetary union for the West African Monetary Zone and integrating with the WAEMU. Also, [31] investigated the proposed African monetary union in the context of OCA using data from 1981 to 2009. The methodology used was a dynamic panel GMM to test for convergence which indicates there is a lack of convergence therefore the need for countries to work towards eliminating cross-country differences to ensure convergence. Moreover, Amoah (2013) undertook a feasibility study of a single currency for the West African Monetary Zone accessing the performance of the WAMZ countries using Macroeconomic Convergence Criteria (MCC) from 2001 to 2011. It used time-series data from 1980 to 2011 based on Ghana, Nigeria, and the Gambia. The study put forward that, the WAMZ is not ready to form a monetary Union hitherto not an optimum currency area. Contrarily, Anokye and Imran (2013) evaluated the possible impact of ECOWAS currency union on intra-regional trade in West Africa using data span from 1995 to 2010. The methodology adopted was an augmented gravity model using a dynamic OLS estimation technique. The results showed currency union has a significant positive impact in the sub-region with other countries responding negatively to currency union membership.

The estimates showed that countries such as Burkina Faso, Benin, Niger, Togo, and Senegal trade more with countries they share a common currency with compared to their short and long-run trade using sovereign currencies. The study recommended the need to intensify efforts towards adopting a common currency. Also, Kamara (2015) analyzed the proposed Currency Union of the Economic Community of West African States. The methodology adopted was cluster analysis to evaluate whether the countries have similar characteristics or not. The study showed that countries are heterogeneous in diverse ways and intra-trade among the countries in the sub-region is not adequate to yield the benefits expected from the union. The study further posits that ECOWAS is not an optimal currency Area therefore risky to form a currency union. Furthermore, Mensah (2016) analyzed trade of West Africa Economic and Monetary Union using data from 2002 to 2013. The methodology used was the Optimal Currency Area criteria to analyze the convergence of real growth, the convergence of prices using inflation, and financial market integration using the monetary policy rate. The trends in the convergence showed whether the WAMZ form an Optimal Currency Area using data sourced for five WAMZ countries. The study concludes that based on trade WAMZ is not an Optimal Currency Area. However, there is a convergence in Real GDP growth, monetary policy rate, and inflation.

Based on the theoretical considerations, we augmented the gravity model of international trade to estimate the effect of currency union on trade following empirical works [32-34] and many others. The augmented model is stated as follows;

Currency union (CU) effect on trade

Where i and j denotes countries, t denotes time, and the variables are defined as: ij x denotes the value of bilateral trade (exports) between i and j , y is real GDP, is population, Dij is the distance between i and j ij cont , is a binary variable that is unity if i and j share a land border, Langij is a binary variable that is unity if i and j have a common official language, is a binary variable that is unity if and were colonized by the same colonial master. ijt CU is a binary variable that is unity if i and j use the same currency at time t , t (ij ) V is the volatility of the bilateral (between i and j ) real effective exchange rate in the period before t , εij is a vector of nuisance coefficients, and represents the myriad other influences on bilateral exports, assumed to be well behaved. ij Volat is a binary variable that is unitary if the exchange rate is low peaked in period t . ij Deffect , for trade creation or trade diversion effect, is a binary variable that is unitary if one is a member of a currency union. A significant positive value depicts trade creation and otherwise trade diversion. The variable was introduced after the common currency effect on trade was estimated in the first model.

Where I = 1, 2, …… N is the number of countries where N =16 (Including Mauritania), t is the time-series dimension of the data ( T =18 years), the coefficients β0 β1 β2 β3 β4 β5 β6 are parameters for their respective variables where β0 is the constant and ε is the error term. The coefficient of interest isτ , γ and r .

Estimation Strategy

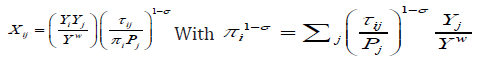

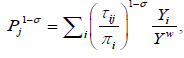

The effect of the proposed currency union on intra-regional trade is captured by τ , our coefficient of interest for the first model and γ for the second model. The standard Anderson and Van [35] gravity model of international trade has been estimated using a fixed effect approach given as follows;

Where Xij is the export value from the reporting country i and trade partner j , τij represents the trade costs between i and j , πi and Pj are outward and inward multilateral resistance respectively. The variables , Yi Yj and Yw are i 's , j ' s and world GDP whilesσ show the elasticity of substitution.

Although the authors recommend estimating the gravity model using a log linearized approach, it is now standard to estimate the AvW model with a fixed effect Poisson Pseudo Maximum Likelihood (PPML) since it controls for heteroscedasticity, zero trade, and model misspecification (Gourieroux et al, 1984: Silva Santos and Tenreyro, 2011). Thus, the PPML includes observations with zero trade values of which linear estimation techniques will drop because the logarithm of zero is undefined which leads to sampling selection bias. As a result, the omission of relevant observations poses serious problems, and information is loosed (Eichengreen and Irwin, 1996). Furthermore, the robust standard errors do away with problems associated with panel data estimation including autocorrelation. Also, PPML fits the data better by controlling for heteroscedasticity than a log-linear model since the error term has a variance occurring at a higher moment which can be influenced by one or more explanatory variables [18].

Thus, the second and highest moment conditions are absent from the estimation procedure. Therefore, the coefficients of log linearized models can be highly misleading due to the presence of heteroscedasticity. Moreover, the PPML unlike the log-linear estimator estimates the effect of policy variables on trade whereas the log-linear estimator estimates the policy variable on the log of trade which can be misleading. Additionally, the PPML is consistent with a small sample size as well as a large sample size. To buttress, the Monte Carlo simulation test on the best estimator for the gravity model of international trade stipulates the gravity model is best estimated as a non-linear model [36]. Further studies on the best estimator for the coefficients of the gravity model is the PPML (Bobková, 2012; Vavrek, 2018). Given this, the PPML estimation technique becomes the best option to estimate the parameters.

Data and Measurement

The study used a dataset with 4,320 bilateral trade observations spanning from 2000 to 2017 (some observations are missing for the dependent variable). The study used the fifteen countries in the ECOWAS sub-region and Mauritania. A summary of all of these variables, how it is defined, measurement and data sources are presented in Table 1. Appendix Table 1. in the Appendix presents the variables in the model, description, measurement, and expected signs.

Variable Definition

We introduced export as a proxy for bilateral trade to represent trade flows between country-pairs since the level of imports is usually underestimated. GDP was used to proxy for the mass of the country in the gravity model whereas GDP per capita was used as a proxy for as many variables that affect trade not specified in the model. The distance was the kilometer distance that exists between the country- pairs. GDP at Purchasing Power Parity was introduced as a proxy for the nominal performance of the US dollar. To compute for exchange rate volatility, the standard deviation of the moving average of the natural log of Real Effective Exchange Rate (REER) was used due to the latest development in exchange rate volatility measure [37,38]. A recent development in trade stipulates countries are no more interested in the value of their currency with another country, but rather how its currency is valuated with their major trading partners [38]. A real effective exchange rate is the nominal effective exchange rate (a measure of the value of several foreign currencies) divided by a price deflator or index of costs. According to Serenis and Tsounis (2012), the main criticism of using standard deviation as a measure for exchange rate volatility fails to capture the potential effects of high and low peak values of the exchange rate. The high and low peak values refer to the unpredictable factor which affects trade. As a result, the peak of exchange rate volatility was computed as the average of the volatility, deducted from the various values and represented by 1 if low peaked and 0 otherwise. A highly peaked exchange rate discourages trade by increasing the cost of trading among trading partners whereas low peaked exchange rate volatility encourages trade.

The variable ‘exchange rate peak (Volat)’ was used to capture this effect in the study. Spatial theory of trade depicts that countries sharing border tends to cooperate to enhance trade. The dummy ‘border’ was represented with 1 if country-pairs share the same border and 0 otherwise. Adam Smith argued in ‘Wealth of Nations’ that common language enhances trade and exchange utilizing effectively communicating the task at hand to the trading partners and easily convincing parties to know it is in their best interest. The dummy ‘common language’ was represented 1 if country-pairs shared a common official language and 0 otherwise. The currency union dummy is 1 when WAEMU countries are paired and 0 otherwise.

This section of the paper reports the trend and discusses the empirical results obtained from the Poison Pseudo Maximum Likelihood (PPML) estimation method. These results are reported in Tables 2-4. In Figure 1, the exchange rate volatility of ECOWAS currencies was noted to harm the level of trade in the sub-region. From the years 2003, 2005, 2012, and 2016 exchange rate volatility of the West African currencies peaked high whereas intra-regional trade peaked lowest. Also, the years 2004, 2006, 2009, and 2013 recorded low peaked West Africa currency volatility with a high level of intra-regional trade in West Africa. Additionally, the years 2002, 2007, 2014 showed the exchange rate volatility of West African countries was rising whereas intra-regional trade flows were declining. Also, in the years 2008, 2010, and 2015 both exchange rate volatility and intra-regional trade were high due to a decline in the value of the US dollar. From the analysis, countries using sovereign currencies have a greater adverse effect on the level of trade in the sub-region.

Note: *, ** and *** represent rejection of null hypothesis at 10%, 5% and 1%. Robust Standard Errors are in the parenthesis.

Note: *, ** and *** represent rejection of null hypothesis at 10%, 5% and 1%. (S.E in parenthesis)

Note: The Minimum and Maximum depicts the range for trading

As a result, the high demand for the US dollar to trade which in turn has a damaging effect on the returns on international markets and the growth of the sub-region. Currency union is superior to fixed exchange rates due to price transparency across countries and intense trading within countries than merely trade among countries. In this background, the currency union generates incentives for private investors to actively indulge in international trade by creating a large market for tradable and non-tradable goods (Rose, 2000). In conclusion, sovereign currencies are some major impediments to trade in the sub-region compared to other trading blocs due to the non-convertibility of the sovereign currencies and the compounding effect of the demand for foreign currencies to trade with another. The relative instability of member-states currencies deters capital inflows from foreign investors.

In Appendix Table 1, the estimated coefficient is 1.274 for GDP is statistically significant at 1%. Interpreting the coefficient as semi-elasticity, a 1% increase in GDP leads to a 0.013% increase in the level of trade. Specifically, this finding is not startling because a higher GDP will make it possible to raise the level of trade in the sub-region. Vijayasri (2013) argues that countries will comparatively produce more of a particular commodity to trade with other countries for what existing resources cannot produce. As the countries produce more, economic activities in the economy rise in line with GDP, therefore, stimulating more trading effect. GDP per capita is found to have a positive relationship with trade as the estimated coefficient is 1.497 and statistically significant at 1%. Interpreting the coefficient as semi-elasticity, a 1% increase in GDP per capita leads to a 0.015% increase in trade. GDP per capita was used as a proxy for all other variables not specified in the model, the result shows that other relevant factors facilitated trade in the sub-region. Distance is found to hurt trade with an estimated coefficient of -.001 and statistically significant at 1%. Interpreting the coefficient as semi-elasticity, an increase in distance between countries is associated with about a 0.00001% decrease in trade. This implies that as distance increases, the trade cost increases, therefore, reducing the level of trade among member states. The result is in line with the Torres and Seters (2016), who argued that the prevalence of barriers hampers trade in the sub-region over long distances due to an increase in trade cost, therefore, generating greater incentives for informal trade in the sub-region.

Border is found to have a positive but insignificant impact on the level of trade among countries. The estimated coefficient of .278 and can be partly supported by Masson [39] that intra-regional trade tends to increase if countries on average share border with four other countries. The insignificance of the impact of the border on trade indicates that the existence of borders has not played any significant role in trade in the ECOWAS zone.

Language is found to have a positive and significant impact on trade at 5%. The estimated coefficient of .996 shows that countries in the sub-region trade more with other countries of the same official language. This partly reinstates the fact that countries in the WAEMU region trade more compared to countries in the WAMZ (Africa Development Report, 2017). Countries sharing the same colonizer are found to have a negative significant effect on trade at 5%. The estimated coefficient is -1.049 which indicates that countries barely trade with other countries mainly due to having a common colonizer. The result is startling but intuitively plausible since countries trade more with their colonial masters than countries of the same colony. Also, trading based on having a common colonizer ties members into other treaties, therefore, suppressing the gains from trade. According to the WTO database, countries in the ECOWAS countries trade more with their foreign partners than with one another. In this background, Settles [40] argued that colonization led to the current political, cultural, social, and economic structure of Africa especially West Africa where the trans-Atlantic slave trade was executed. Sharing a common currency is found to have a strong positive and significant impact on trade.

The estimated coefficient is 1.487 and statistically significant at 1%. The result shows that adopting a common currency reduces transaction costs, therefore, stimulating trade through savings. The estimate of the currency union effect on trade in the sub-region can be partly attributed to the savings resulting from the reduced transaction costs among member-states. Exchange rate volatility is found to have a negative and significant effect on trade in the sub-region. The estimated coefficient is -.281 and statistically significant at 10%. Interpreting as semi-elasticity, exchange rate volatility is associated with a decline in trade considerably of about 0.028%. The result shows that the exchange rate plays a far more expected role in the level of trade in the sub-region. Thus, when exchange rate volatility is high, the level of trade declines among member states since it increases the cost of trading. According to Tchokote et al [41], exchange rate volatility casts down net-export in the sub-region therefore adversely affecting trade flows. The exchange rate peak is found to have a negative significant effect on trade. The estimated coefficient is -4.080 at 1%. The result shows that the exchange rate was highly peaked for most trading periods in the years under study. This partly accounts for the low level of trade among member states in the sub-region. The high or low peak captures the unpredicted variation of exchange rate volatility affected exports. The higher the value of unpredicted factors, the greater the adverse effect of volatility on exports hitherto trade. The higher the volatility (high peak), the greater the adverse effect on the level of exports [42].

Defect is found to have a positive significant effect on trade and statistically significant at 5%. The estimated coefficient is .940 which shows that adopting a common currency will lead to trade creation. This implies the use of a common currency in the ECOWAS sub-region will impact trade to stimulate economic growth [43-49].

The positive mean value (0.16) depicts that countries in the sub-region are trading. However, the countries are not maximizing the level of trade flows with one another due to relatively poor diversification of the economies and greater barriers to trade (shown by comparing the mean value to the maximum value of 4.16). Therefore, could be trading more based on their geographical and economic fundamentals. In this context, there are impediments to trade in the sub-region. The use of a common currency and coordination of economic policy can be a means of unleashing the trade potential in the sub-region. Intuitively, the greater trade potential will unleash a multiplying effect on the trade creation effect of adopting a common currency.

Concluding Remarks

The pursuance of currency union in Africa is more economically than politically motivated. This paper has shown sovereign currencies in the ECOWAS sub-region are barriers to trade due to the adverse effect of exchange rate volatility. Therefore, the low intra-regional trade averaging below 12% of total trade can partly be attributed to the use of sovereign currencies. Currency union is a means of eliminating the effect of exchange rate volatility and ensuring price transparency among member-states. Using the PPML, the results show that adopting a common currency in the sub-region will stimulate trade flows in the sub-region. Also, the ECOWAS currency union will have a trade creation effect, therefore, stimulate economic growth. Furthermore, countries are not trading enough signaling greater trade potential based on economic and geographic fundamentals. Per the analysis of the effect of the proposed ECOWAS currency union on intra-regional trade, the study proposed the following policy implications. Empirical results indicate that selected variables have a strong impact on trade in the ECOWAS sub-region and hence economic growth. The proposed common currency was found to have a positive impact on trade in the sub-region. Therefore, the ECOWAS sub-region has an incentive to adopt a common currency by achieving the nominal convergence criteria.

In this background, the ECOWAS should focus on providing technical support to all member states to facilitate the attainment of the convergence criteria for the policy to be realized. Exchange rate volatility was found to hurt trade in the sub-region. With the implementation of a common currency, exchange rate volatility and inflation bias among countries will be eliminated. In this context, ECOWAS’s focus should be on the stability of the common currency to be adopted. Thus, ECOWAS should focus on the development of the financial markets due to its ability to reduce the volatility of currency by indexing all financial assets using the common currency and building financial market buffers. Financial institutes are to be listed in the common currency which in turn will attract potential investors to gain confidence in different ECOWAS countries’ financial markets.

ECOWAS should advise countries on the need to monetize their fiscal deficits, which depreciates the value of the currency and increases the debt servicing obligations of countries by adhering to policies initiated by the proposed West Africa Central Bank. Also, the need for countries to adhere to the fiscal convergence criteria to ensure a sustainable currency union. Further more, the results showed that trade as a result of adopting a common currency will have a trade-creation effect in the sub-region. Therefore, the ECOWAS should implement policies to reduce the outflow of FDI and restrict the outflow of financial assets from the sub-region. In this context, the benefits of joining a currency will be fully-fledged. Also, the ECOWAS should set up an institution to undertake trade-related issues among member-states. Finally, the trade potential of the sub-region was estimated to unveil greater prospects of trade in the sub-region and the need to be tapped. In this background, the result showed countries are not fully maximizing their trade with one another in the sub-region.

The focus of ECOWAS should be centered on eliminating trade and non-trade barriers by forming a currency union. In a nutshell, the study recommends that all else equal, it is economically viable that ECOWAS should initiate the policy on currency union with a common policy as a stepping stone to increase intra-regional trade in line with regional growth (Appendix Text) (Appendix Figures 1-5).