Abstract

The genetically modified (GM) canola grown in Western Australia (WA) is glyphosate resistant. It has been grown in WA since 2010, when an exemption under the WA GM Moratorium was declared. The price penalty for GM canola (compared to non GM canola) is 7.2% based on the past five years of price data from two WA receival depots (Albany and Kwinana). The average annual price penalty for GM canola varied from a low of 5.3% ($29 per tonne in the 2017/18 season at Kwinana) to a high of 9.2% ($49 per tonne in the 2015/16 season at Albany). WA GM canola has a lower oil content (e.g. 46.9% versus 48.4%) and a higher moisture content (e.g. 5.5% versus 5.3%) than non GM canola. It is suggested that the price penalty for GM canola in WA would be greater if the segregation, phytosanitary and cleaning regimes were more stringent, rather than tolerating 0.9% contamination by GMOs for WA’s so called ‘non GM canola’. In the future, the price penalty for GMOs may be higher as consumers and purchasers become aware that what has been passed off as ‘canola’ is GM canola. The Canola Receival Standards make no mention that 0.9% contamination of non GM canola (CAN1) by GMOs is tolerated. As markets tighten up their tolerance of GM contamination, the risk is that WA’s so called ‘non GM canola’ suffers market exclusions.

Keywords: Genetically Modified Organisms; Genetically Engineered Organisms; Price Penalty; Western Australia; Monsanto; Roundup Ready Canola; Canola; Glyphosate

Introduction

Twenty percent of Australia’s canola crop is genetically modified (GM) [1]. The only GM canola grown in Australia is glyphosate-tolerant canola [1]. GM crops, also known as genetically engineered (GE) crops, have been contested from the outset. Meanwhile, consumers are keen to avoid GM food [2]. GM canola was approved for planting in Australia in 2003 by the Office of the Gene Technology Regulator, an agency of the Australian Federal government. Australian states and territories can exclude GM crops from their region on the basis of trade and/or marketing (but not on the basis of health and safety) [1]. GM canola was excluded from Western Australia under the state’s GM Moratorium of 2003 [3]. Following a change of government, the incoming conservative government (Liberal and National coalition) made an exemption in 2010 for Monsanto’s genetically modified (GM) Roundup Ready (RR) canola. That first annual GM canola crop (in 2010) contaminated a WA organic farm which subsequently lost it organic certification [4]. The matter was contested in the courts without success [5].

GM RR canola was developed by Monsanto as a crop resistant to the herbicide gyyphosate [6]. There is no claim or suggestion by Monsanto that there is any yield benefit, and it was not bred with that objective. The proclaimed benefit to farmers is that they can be less discriminating in their application of herbicide spraying since the GM crop does not need protection. In WA, it is reported that Monsanto’s GM canola varieties tolerated, for example, “a sequential application of glyphosate … followed by two-way tank mix of glyphosate with atrazine, butroxydim, clethodim, clopyralid, haloxyfop and terbuthylazine at the label rates” [7]. WA grows 40% of Australia’s annual 2.7 million tonne canola crop [8]. Most of WA canola is exported, it is valued at AU$600 million per annum, and the major markets are the Netherlands, Belgium, Germany and Japan [8]. About 34% of WA’s canola is GM canola and it accounts for 366,466 hectares [9].

Materials and Methods

Price data for grains are published regularly in Perth’s leading newspaper, The West Australian, and elsewhere. The CBH Group Receival Standards specify four grades of canola: CAN1 and CAN2 (first and second grade non GM canola), and CAG1 and CAG2 (first and second grade GM canola, also described as ‘GMO canola’) [10]. For the present study, longitudinal average annual price data were supplied for CAN1 (non GM canola) and GAG1 (GM canola) [11]. The findings, submissions, and hearings evidence from the WA Parliamentary Inquiry (2017-2019), Inquiry into mechanisms for compensation for economic loss to farmers in Western Australia caused by contamination by genetically modified material (www. parliament.wa.gov.au) were available for the present study.

Results

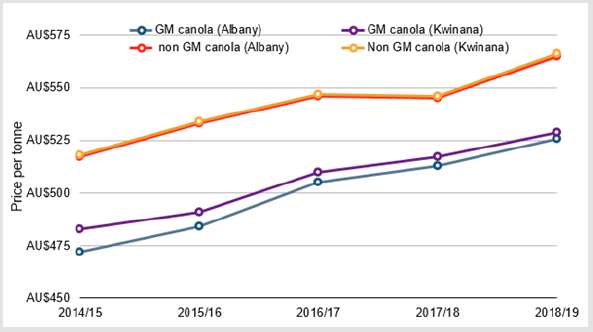

The price data for canola in Western Australia reveal that there is a consistent price penalty for GM canola compared to non GM canola (Figure 1). Over five years and two grain receival depots (Albany and Kwinana), the average GM canola price penalty is 7.2% (AU$39 per tonne). At Albany, the annual price penalty for GM-canola varied from a low of 5.9% ($32 per tonne in the 2017/18 season) to a high of 9.2% ($49 per tonne in 2015/16). At Kwinana, the annual price penalty for GM-canola varied from a low of 5.3% ($29 per tonne in the 2017/18 season) to a high of 8.1% ($43 per tonne in 2015/16) (Figure 1). GM canola consistently underperforms on price (compared to non GM) over each of the five years and at each of the receival depots (Figure 1). The annual average price of non GM canola at the receival depots is near identical to each other for all five years, differing only by $1 within a year (Table 1). The price of GM-canola exhibits more volatility between depots, with a price difference per tonne varying from $10 per tonne (in 2014/15 season) to $2 per tonne(in 2018/19) (Table 1). WA GM canola has a lower oil content compared to non GM canola (46.2% compared to 47.2%, and 46.9% compared to 48.4%, at Albany and Kwinana respectively). WA GM canola has a higher moisture content compared to non GM canola (6.4% compared to 6.1%, and 5.5% compared to 5.3%, at Albany and Kwinana respectively) [12].

Figure 1: Average annual price per tonne of GM canola versus non GM canola, for grain delivered in WA (Albany and Kwinana) (author’s graph; data source: Taylor, 2019).

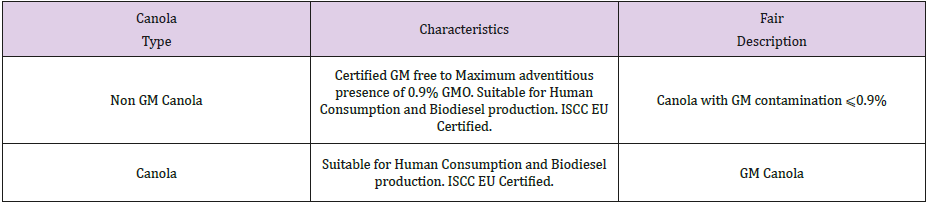

Table 1: The two types of canola on offer by CBH [reproduced from 12] (third column of commentary added by author.)

Discussion and Conclusion

GM canola attracts an average price penalty of 7.2%. With increasing market awareness and transparency there are reasons to anticipate that this price penalty will not only persist but increase. Consumers and grain purchasers are entitled to know what they are buying, and to avoid GMOs if that is their preference. That is easier said than done. Fair description: The CBH Group is “Western Australia’s largest acquirers of all grains” [13]. However matters get somewhat muddled when it comes to marketing WA canola. In the Commodities & Products listing of CBH there are two types of canola on offer: ‘Non GM Canola’ and ‘Canola’ (see Table 1). Both of these types are less than they might appear, and the descriptions may be liable to challenge under Australian consumer law as being ‘misleading and deceptive’ [14]. Neither ‘type’ is ‘described as ‘GMfree’, and neither is. But also, neither is described as ‘GM canola’ while both may be GM, fully or to some extent. What CBH calls ‘Canola’ is GM canola (Table 1). What CBH calls ‘Non GM Canola’ (CAN1) may be up to 0.9% GMOs. (Table 1). The market does not want to be duped. Marketing clarity using fair descriptions (e.g. see Table 1) treats the buyer with respect and earns respect for the seller. Using fair and clear descriptions may further increase the price penalty of GM canola as greater awareness and transparency leads buyers to further eschew GMOs.

Contamination: CBH boasts of WA as “one of the world’s purest environments” [12]. Unless this is viewed as mere puffery, then one might reasonably expect this purity to have some carry through to products, otherwise why boast of it? Would 0.9% sand in your baguette be OK, or 0.9% bird droppings in your omelette, or 0.9% aviation fuel in your infant formula? So how is 0.9% GM contamination in canola acceptable to an informed consumer? Consumers around the world are actively avoiding GMOs in their diet [2]. More stringent standards for GM contamination of non GM canola could be expected to increase the price penalty for GM canola (by passing through the increased costs of effective segregation practices to the GM sector). Segregation has failed: It has been claimed that the segregation of GM and non GM has been successfully implemented in WA [15]. The standard of allowing 0.9% contamination of GM in non GM grain puts the lie to that. The WA State Agricultural Biotechnology Centre states that “100% pure” is “impossible” and that “100% purity is wholly impractical” [16]. There are phyto-sanitation costs to be borne if GMOs are regarded and managed as invasive species [17]. GM canola sells for less than non GM canola and GM contamination events damage the business and reputation of the whole grain sector.

Perverse incentive: The 0.9% ‘acceptable’ contamination level [18] creates a perverse incentive to ‘bulk up’ non contaminated non GM canola with its cheaper cousin, GM canola. The lax standard creates an incentive to contaminate, by adding the cheaper GM product to the higher value non GM product until the threshold of ‘acceptable’ contamination is reached. Zero tolerance is coming: Consumers and manufacturers are entitled to avoid GMOs for health, environment, ideological or other reasons. This fair entitlement is being subverted by the marketing to customers of ‘non GM canola’ which is no such thing. The current phytosanitary, cleaning and segregation regimes in place in WA (and elsewhere) that tolerate 0.9% GMO contamination are clearly deficient and fail to meet consumer expectations. Japan is now moving towards “zero tolerance for GE components” and the proposal is that “the term ‘Non-GE’ now only be allowed where GE is non-detectable” [19]. With the uptake of zero tolerance and non-detectability for non GM products, the pressure will be on WA to implement effective segregation of GMOs and to safeguard the majority of canola growers, who would be price penalised if their crop is found to be GMO contaminated and if it were thereby downgraded to GM. As the zero tolerance movement gains momentum, all grain growers in WA will have a stake in ensuring the effective segregation of GMOs, or, alternatively, reverting to a GM Moratorium if that is “impossible” as is claimed by Jones [16].

Glyphosate is retreating: “Currently, the only GM canola grown commercially in Australia is glyphosate-tolerant canola” [1]. The premise of such GM glyphosate tolerant canola is that it can be doused in glyphosate with impunity. However, the time for that impunity has passed. Glyphosate is now classified as a carcinogen [20]. The herbicide is pervasive in the food chain [21]. Increasing consumer and government push back against such contamination can be anticipated. In the USA, farmers of GM soy use 28% more glyphosate than non GM soy farmers [22] and farmers of GM canola seem likely to follow the same pattern of practice. Monsanto was ordered to pay US$289 million in what is described as “the world’s first Roundup cancer trial” [23]. “A landmark verdict found Roundup caused a man’s cancer, paving the way for thousands of other families to seek justice” [24]. More glyphosate lawsuits are coming, with 9,300 plaintiffs reported [25]. Glyphosate is a technology in retreat, and likewise must be its handmaiden, GM glyphosate dependant crops. The pushback can be expected to be multifactorial, coming from farmers, consumers, insurance companies, regulators and courts.

There is a price penalty for GMOs. Informed consumers are avoiding GMOs. Segregation of GMOs is failing. Glyphosate is a legal liability. Monsanto, even with its new owner Bayer, remains a pariah company pushing pariah crops, and operating without social licence [26]. There are multiple reasons to expect that, in the near future, the current price penalty for GMOs will only increase from the 7.2% price penalty reported here.

References

- (2018) OGTR, Genetically modified (GM) canola in Australia Canberra: Office of the Gene Technology Regulator (OGTR).

- (2017) GfK, Decision Factors on What to Eat or Drink: Global GfK Survey. London: GfK (Growth from Knowledge).

- (2003) WA Parliament, Explanatory Memorandum, Genetically Modified Crops Free Areas Bill. Perth: WA State Government.

- Paull J (2015) The threat of genetically modified organisms (GMOs) to organic agriculture: A case study update. Agriculture & Food 3: 56-63.

- Paull J (2015) GMOs and organic agriculture: Six lessons from Australia. Agriculture & Forestry 61(1): 7-14.

- (2019) Monsanto, Why Roundup Ready? Melbourne: Monsanto Australia.

- Dhammu H, M Seymour (2018) Herbicide tolerance of canola, in Canola Agronomy Research in Western Australia. Perth, p. 55-57.

- (2019) DPIRD, Agriculture and Food-Canola Perth: Department of Primary Industries and Regional Development (DPIRD), Government of Western Australia, p. 55-57.

- (2019) ABCA, Statistics: GM Canola Uptake Melbourne: Agricultural Biotechnology Council of Australia (ABCA).

- (2016) CBH, 2016/17 Receival Standards. Perth: CBH Group.

- Taylor L (2019) Average cash price for Can1 and Cag1 for each port zone (figures supplied). Perth: Daily Grain.

- (2019) CBH, 2017/18 Crop Quality Report. Perth: CBH Group.

- (2019) CBH, Commodities & Products. Perth: CBH Group.

- (2010) CoA, Competition and Consumer Act 2010 (Cth) (An Act relating to competition, fair trading and consumer protection, and for other purposes). Canberra: Commonwealth of Australia.

- May T (2018) Submission to: Environment and Public Affairs Committee, Legislative Council: Inquiry into mechanisms for compensation for economic loss to farmers in Western Australia caused by contamination by genetically modified material. Melbourne: Monsanto Australia and New Zealand.

- Jones M (2018) Submission to: Environment and Public Affairs Committee, Legislative Council: Inquiry into mechanisms for compensation for economic loss to farmers in Western Australia caused by contamination by genetically modified material. Perth: WA State Agricultural Biotechnology Centre, Murdoch University.

- Paull J (2018) Genetically Modified Organisms (GMOs) as Invasive Species. Journal of Environment Protection and Sustainable Development 4(3): 31-37.

- (2006) GRDC, National limits set for GM canola presence. Ground Cover.

- Sato S (2018) Japan set to modify its GE Food Labelling System. GAIN Report USDA Foreign Agricultural Service.

- (2019) OEHHA, Glyphosate Sacramento, CA: Office of Environmental Health Hazard Assessment (OEHHA), California Environmental Protection Agency (CalEPA).

- Cook K (2019) Glyphosate in Beer and Wine. Sacramento, CA: California Public Interest Research Group (CALPIRG) Education Fund.

- Perry ED (2016) Genetically engineered crops and pesticide use in U.S. maize and soybeans. Science Advances 2(8): 1-8.

- Bender R (2018) Bayer hit by more lawsuits over safety of Roundup weedkiller. The Wall Street Journal.

- Gillam C (2018) The world is against them’: new era of cancer lawsuits threaten Monsanto. The Guardian.

- Bellon T (2018) Monsanto ordered to pay $289 million in world’s first Roundup cancer trial. Reuters.

- Stebbins S (2018) Bad reputation: America’s Top 20 most-hated companies. USA Today.

Research Article

Research Article